COVID-19 surprised us all. It found most business owners unprepared to deal with lockdowns, PPE, hybrid work, vaccinations, supply chain disruptions and labor shortages. It challenged us to be flexible, to be creative, and to be resilient. We’re not over the pandemic, but we’re far enough along to look back at the factors that helped businesses be successful early on.

According to a recent report by the National Association of Professional Employer Organizations (NAPEO), companies with the right HR partners fared better than their counterparts.

If you’ve ever considered using an outsourced HR firm, read on. The data from NAPEO shows the power and value of working with a PEO like NEMR Total HR.

The study compared small businesses that use PEOs with those that don’t. It looked at the likelihood of receiving PPP funding and of staying open. The results, published in a new white paper, are significant and often startling.

More likely to have received PPP Loans

PPP, the ambitious federal fiscal program, was a stroke of good fortune for millions of businesses. A preliminary study by the Brookings Institute shows that PPP substantially increased the employment, financial health, and survival of small businesses. Yet the speed of its rollout was notably bumpy and bewildering.

Here’s where HR outsourcing made the difference: small businesses that worked with a PEO were 119% more likely to obtain PPP funds compared with their peers.

Let’s look at the numbers more closely. On average almost 66 percent of PEO clients nationally received PPP loans compared with 30% of small businesses that did not work with a PEO. In essence, you were twice as likely to get PPP funding if you outsourced HR to a PEO like NEMR Total HR.

In our case, we assisted the majority of our clients through the PPP process by supporting their executive teams and third-party accounting, financial institutions and banking partners. In the early stages of PPP, there was a lot of confusion in the race to comply and apply. There were varying opinions on what was needed, and many banks had different compliance, documentation and reporting requirements. NEMR worked diligently to provide custom reporting and supporting payroll and tax documentation to ensure our client applications met the standards of their financial institutions.

We are proud to say that 100% of those we assisted received funding.

PEO clients get the early money

The likelihood of getting money in Round 1 of the PPP funding process was greater for companies with a PEO on their team. In fact, PEO clients were 72% more likely to have received PPP loans in Round 1 compared to other small businesses.

The early money gave small businesses a competitive edge and peace of mind.

“Overall, with the initial PPP process now completed. The data are clear: A much higher percentage of PEO clients were able to access PPP loans than comparable small businesses and accessed them more quickly with an extraordinarily high success rate,” the authors concluded.

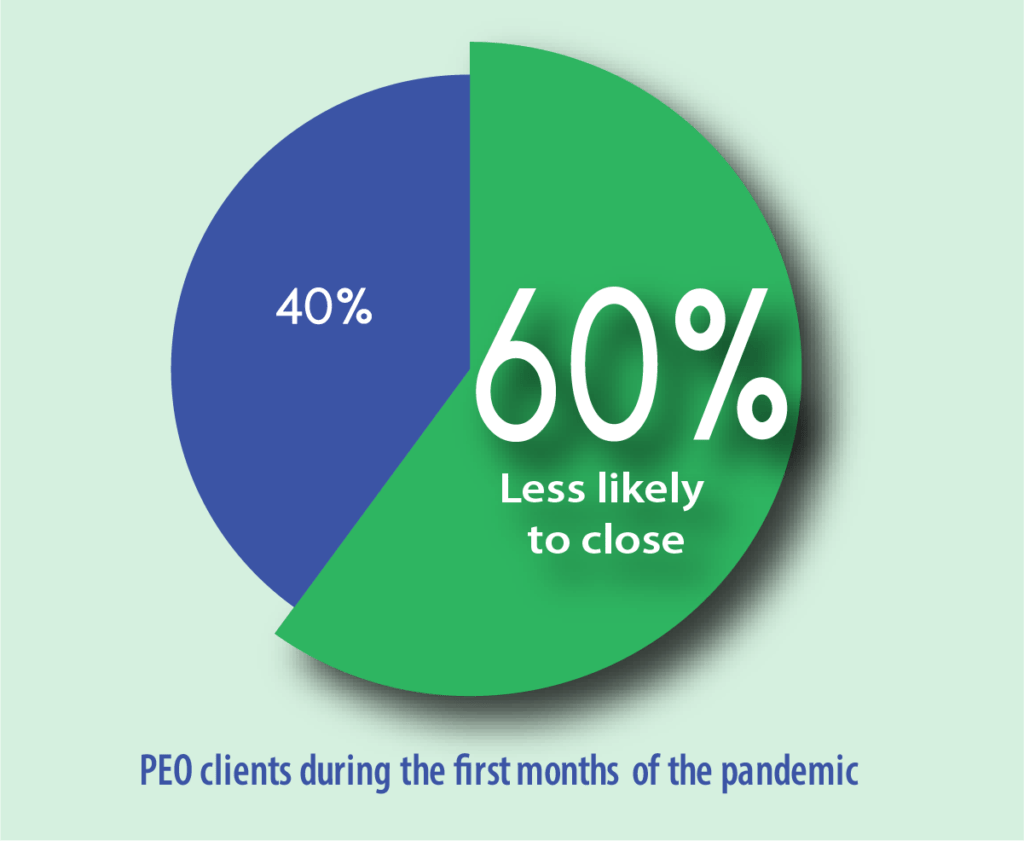

A higher survival rate

Nearly every business goes through ups and downs. The true bellwether of success is sustainability.

The NAPEO report shows companies that did business with a PEO were far more likely to stay open than other small business, regardless of industry. The facts: PEO clients were 60% less likely to have permanently closed in the first months of the pandemic.

While it was challenging for many, For NEMR Total HR clients, 100% weathered the COVID storm and remain in business today.

That’s a result of the many ways we aided our clients. In addition to helping them secure PPP money, we guided them on managing a hybrid workforce, vaccine mandate policies and worksite safety protocols. Making accommodations for protected classes of employees, wage and salary setting for equity, diversity and inclusion and improving company culture were just some of the many issues of 2021. We provided counsel on them all.

We also advised on the labor situation, offering alternate workforce solutions and recruiting of new team members.

“Long term business survival represents the most critical indicator of success for any business in the wake of the massive economic disruption due to the COVID-19 pandemic,” wrote the authors. Having a PEO “is particularly valuable in navigating through a time of uncertainty and new complexities.”

If you need assistance with the complex HR issues related to COVID-19 and beyond, an expert advisor like NEMR Total HR can guide you. Chat Live with us to learn more or Email Us.